Travel Rule Solutions

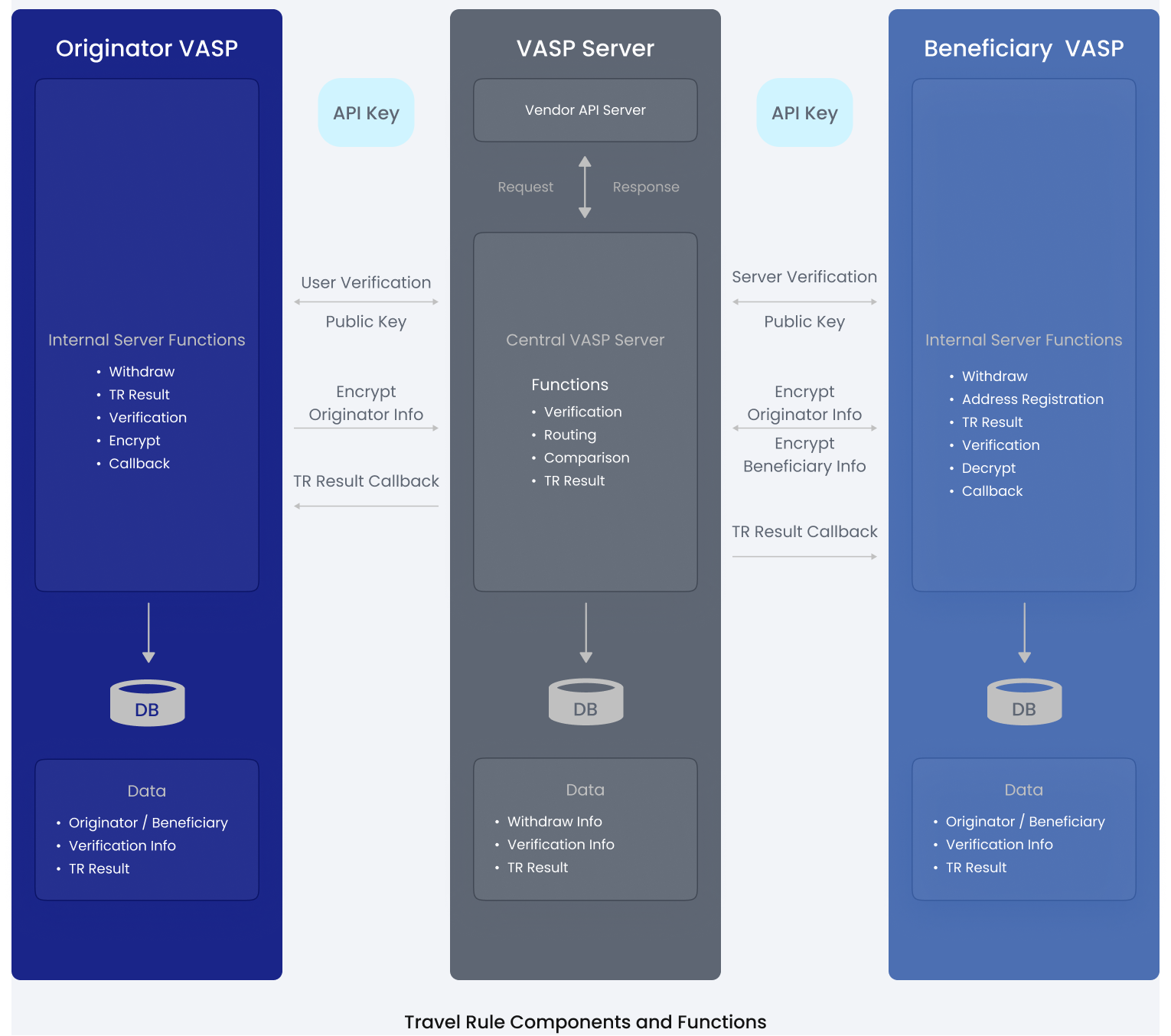

We provide a one-stop shop for all your Global Travel Rule needs. Simply integrate with us once and we will facilitate Travel Rule compliance. Figure 1-1. shows the overview of GTR components and functions.

Figure 1-1. GTR Components and Functions.

Travel Rule Standard 2.0 Solution

Based on the FATF Travel Rule guidelines, in 2022 we developed GTR 1.0, also known as the GTR before-on-chain version, which multiple VASPs have already adopted. To enable GTR to provide Travel Rule services to a wider range of VASP types and more business scenarios, we developed GTR Standard Version 2.0.

GTR Standard Version 2.0 can cover 2 situations:

- Pre-transaction Travel Rule

- Post-transaction Travel Rule

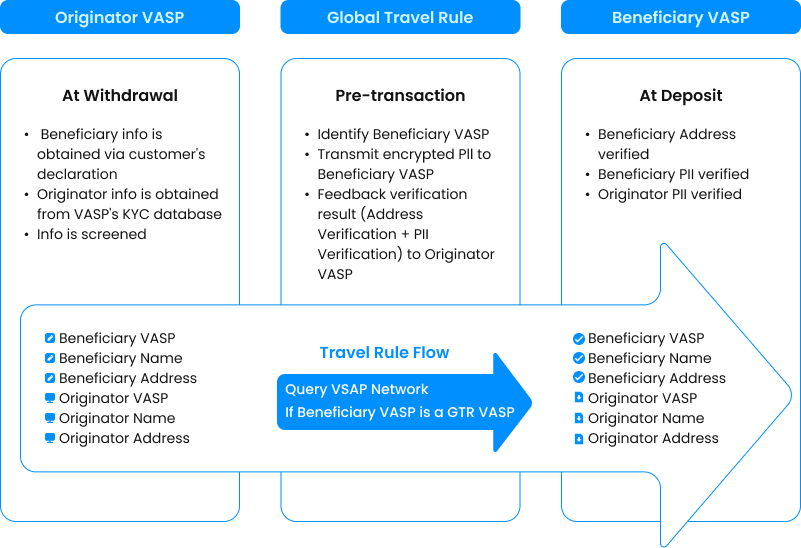

In the Pre-transaction Travel Rule:

- Travel Rule Request Initiator: Originator VASP

- Travel Rule Request Receiver & Verifier: Beneficiary VASP

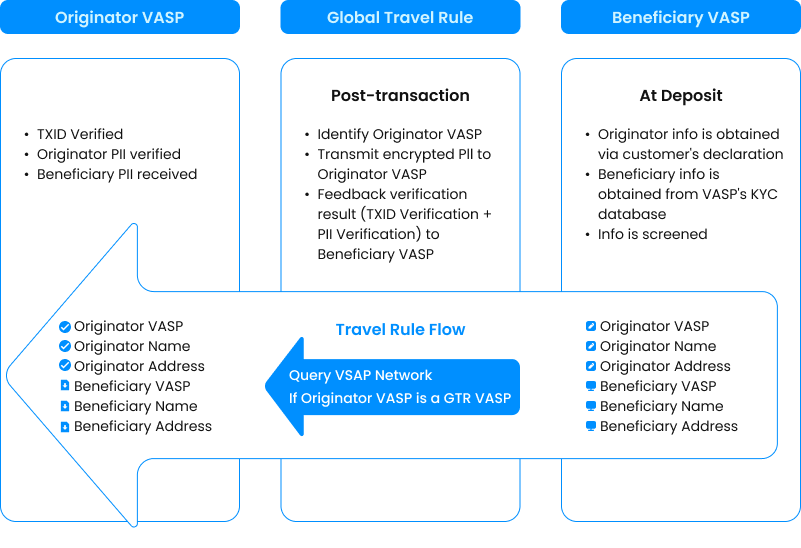

In the Post-transaction Travel Rule:

- Travel Rule Request Initiator: Beneficiary VASP

- Travel Rule Request Receiver & Verifier: Originator VASP

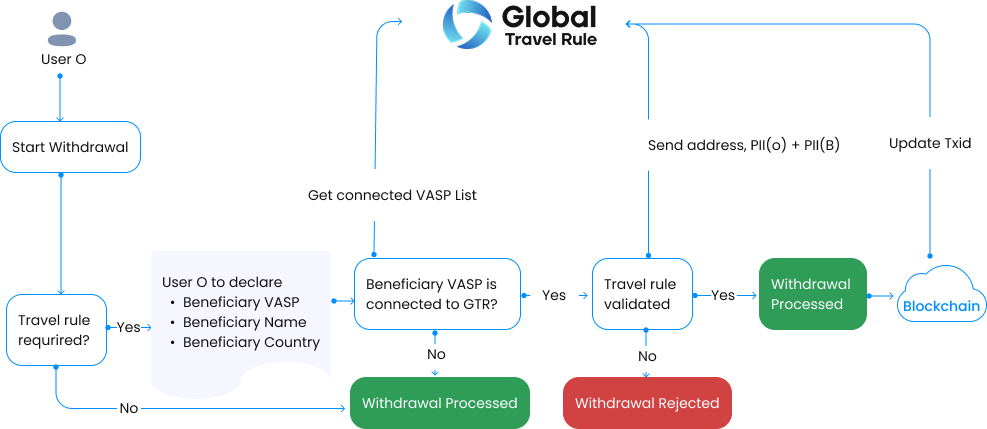

Case A: Pre-transaction situation, PoV of Originator VASP

Scenario Description: When a customer on your VASP initiates a transfer of assets to another VASP but the transaction has not yet been sent to the blockchain, your VASP takes on the role of both the Originator VASP and the Travel Rule Request Initiating VASP. Before the blockchain transaction takes place, your VASP is responsible for preparing and sending the PII payload to the Beneficiary VASP.

| Typical Scenario | Your Travel Rule Responsibility |

|---|---|

| Your customer withdrawal asset to another VASP | Proactively initiate Travel Rule request, prepare and send PII to the Beneficiary VASP |

| Role in Asset Transfer | Transaction Executed on Blockchain? | Role in Travel Rule Request |

|---|---|---|

| Originator √ Beneficiary | Pre-transaction √ Post-transaction | Travel Rule Request Initiator √ Travel Rule Request Receiver Travel Rule Request Verifier |

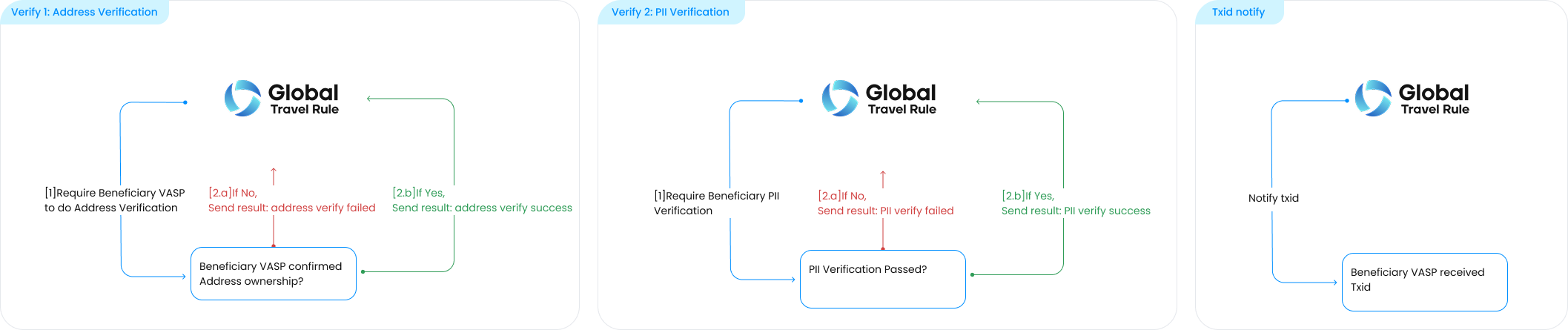

Case B: Pre-transaction situation, PoV of Beneficiary VASP

Scenario Description: When your counterparty VASP sends you a Travel Rule request before the transaction takes place on the blockchain, and in this request, it specifies that a customer from your VASP is expected to receive assets from the counterparty VASP. In this scenario, your VASP acts as both the Beneficiary VASP and the Travel Rule Request Receiving VASP. In this case, your VASP is responsible for completing the verification process when you receive the Travel Rule Request.

| Typical Scenario | Your Travel Rule Responsibility |

|---|---|

| Upcoming deposit from another VASP | Receive Travel Rule Request from counterparty, do the Address Verification and PII Verification |

| Your Role in Asset Transfer | Transaction Executed on Blockchain? | Your Role in Travel Rule Request |

|---|---|---|

| Originator Beneficiary √ | Pre-transaction √ Post-transaction | Travel Rule Request Initiator Travel Rule Request Receiver √ Travel Rule Request Verifier √ |

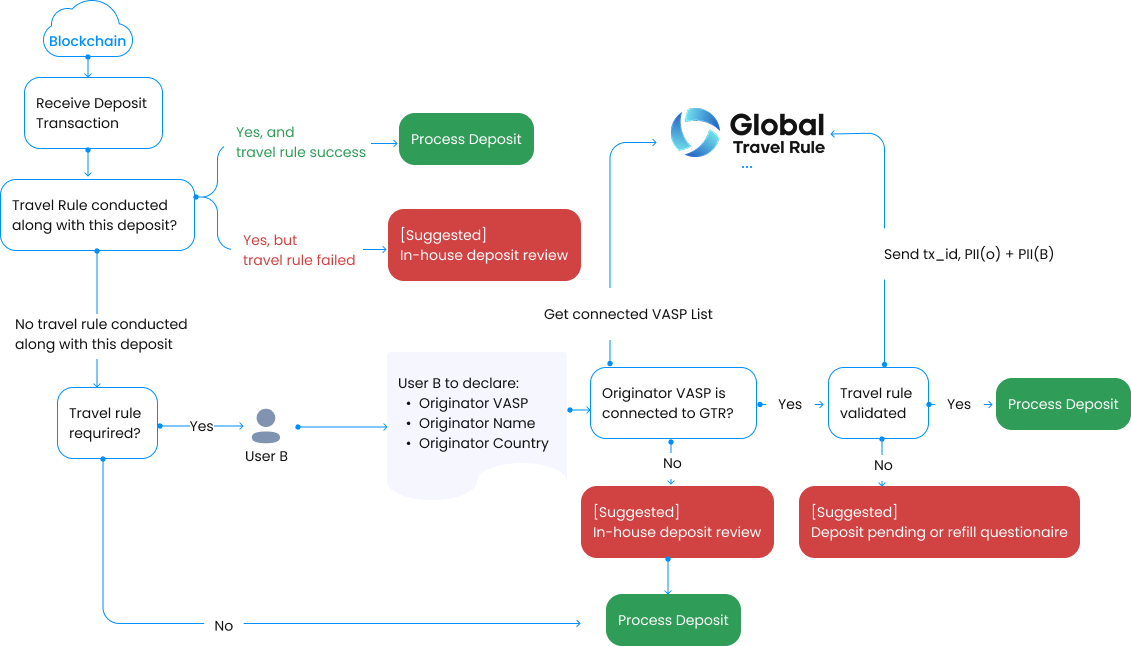

Case C: Post-transaction situation, PoV of Beneficiary VASP

Scenario Description: When your VASP has received assets from a counterparty VASP, and you subsequently request PII verification from that counterparty because there is no Travel Rule record associated with this blockchain transaction, your VASP as the Beneficiary VASP of this asset transfer, becomes the Travel Rule Request Initiating VASP. As such, your VASP is responsible for initiating the Travel Rule request, preparing and sending the PII payload to your counterparty.

| Typical Scenario | Your Travel Rule Responsibility |

|---|---|

| Received deposit without Travel Rule verification | Proactively send Travel Rule Request to Originating VASP and ask for PII Verification |

| Your Role in Asset Transfer | Transaction Executed on Blockchain? | Your Role in Travel Rule Request |

|---|---|---|

| Originator Beneficiary √ | Pre-transaction Post-transaction √ | Travel Rule Request Initiator √ Travel Rule Request Receiver Travel Rule Request Verifier |

Case D: Post-transaction situation, PoV of Originator VASP

Scenario Description: When your VASP received a Travel Rule request from your counterparty VASP after a transaction had already taken place, and in this request, it indicates that a customer from your VASP was the originator of this asset transfer. Your VASP can expect to receive PII payload and is responsible for completing the verification process.

| Typical Scenario | Your Travel Rule Responsibility |

|---|---|

| Processed withdrawal being retroactively verified | Cooperate by verifying PII information in received Travel Rule Request |

| Your Role in Asset Transfer | Transaction Executed on Blockchain? | Your Role in Travel Rule Request |

|---|---|---|

| Originator √ Beneficiary | Pre-transaction Post-transaction √ | Travel Rule Request Initiator Travel Rule Request Receiver √ Travel Rule Request Verifier √ |